Liquidity Bridge Economic and Arbitrage Model

Last updated

Was this helpful?

Last updated

Was this helpful?

This article aims to explain the liquidity bridge token economics and cover the cross-chain liquidity arbitrage system for major assets.

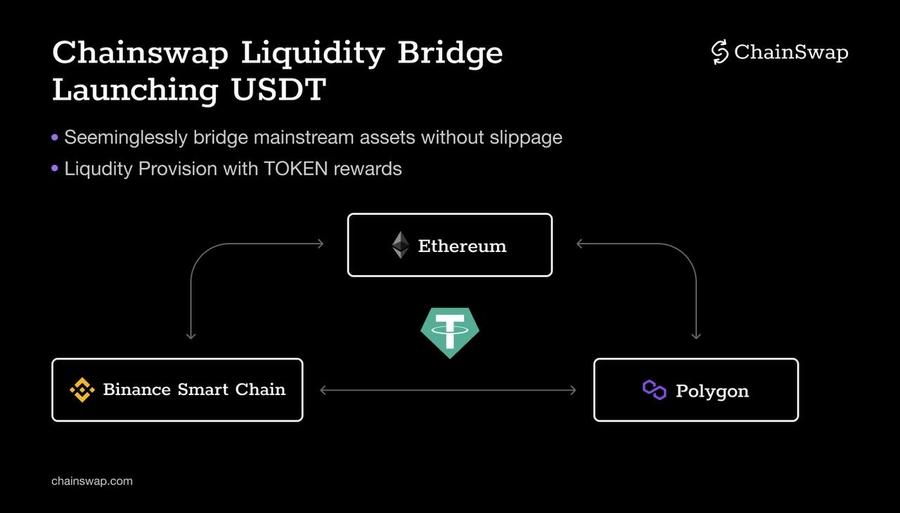

ChainSwap Liquidity Bridge is a dynamic feature that will allow the bridging of mainstream assets (USDT, USDC, DAI..) across all major chains supported by ChainSwap.

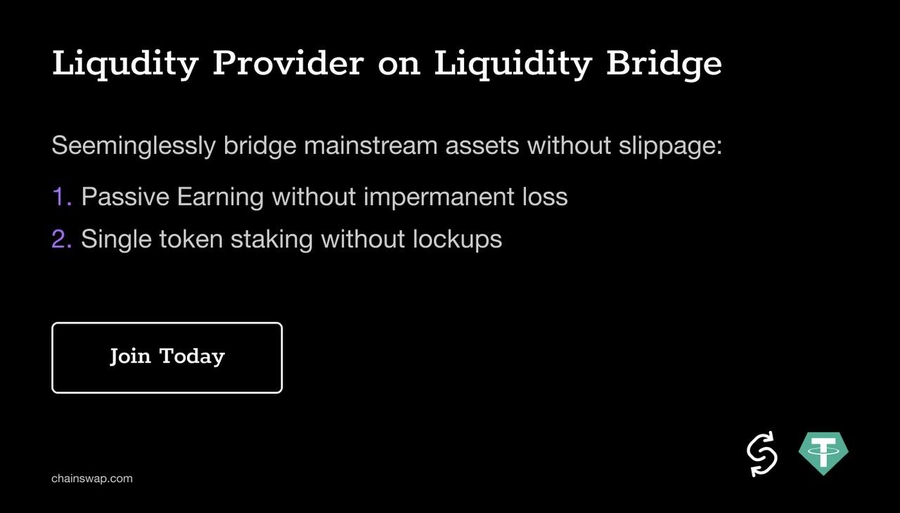

Users will be able to stake their major assets such as USDT as single side LP on ChainSwap and earn rewards.

Dynamic arbitrage system where LPs are able to arbitrage their liquidity and recieve rewards on a FCFS basis

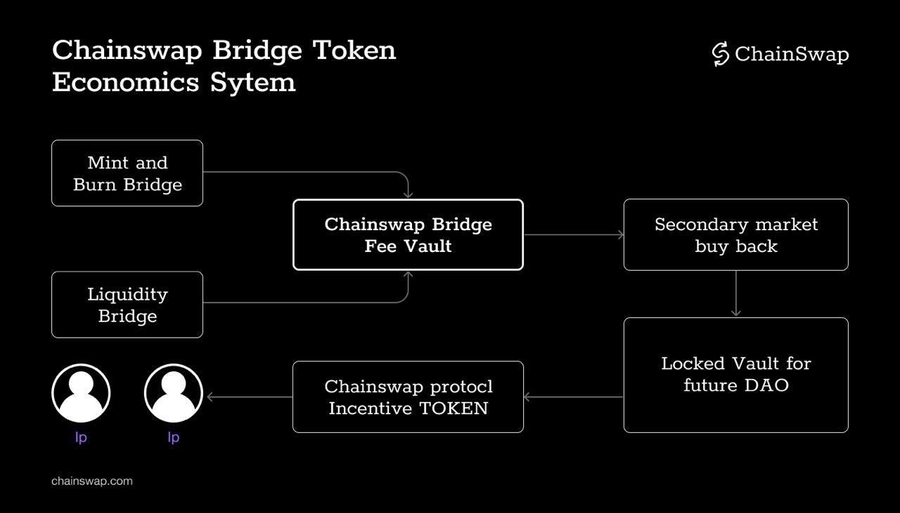

LPs are rewarded in TOKEN

No slippage, no lockup on staked assets

Liquidity bridge fee is set at 0.08% of the asset and a base 0.005 ETH fee

There is a transaction fee for swapping major assets such as ETH/USDT/USDC. This fee is set at 0.08% of the asset and a base 0.005 ETH fee

Fees are used to buyback TOKEN and locked into reward vault DAO.

LPs that provide major asset liquidity earn rewards in form of TOKEN which are a reward mix of protocol rewards pool and the reward DAO pool.

LPs will have the opportunity to arbitrage their assets across chains. As an example lets assume there is $5M worth of USDT staked on ETH but only $500k on BSC. LPs will be able to arbitrage their staked LP to chains with lagging liquidity ensuring best yield.

Additionally users who hold TOKEN will be able to stake it into respective pools earning fee rewards. The staking fee reward is set to be lower than the fee reward for LPs.

There is no lockups on liquidity or staked assets, LPs and users can deposit and withdraw at any given time.

TOKEN rewards are dynamic for both LPs and TOKEN stakers, depending on TOKEN price.

Bridge users that want to swap major assets across chains can do so without slippage. 100,000 USDT swapped from ETH to BSC will still equal 100,000 USDT (- fees) given enough liquidity on both chains.

Initially the pools won’t be capped, if the supply of staked USDT is much more than the demand of the bridge the team might consider capping the pools at at given amount.

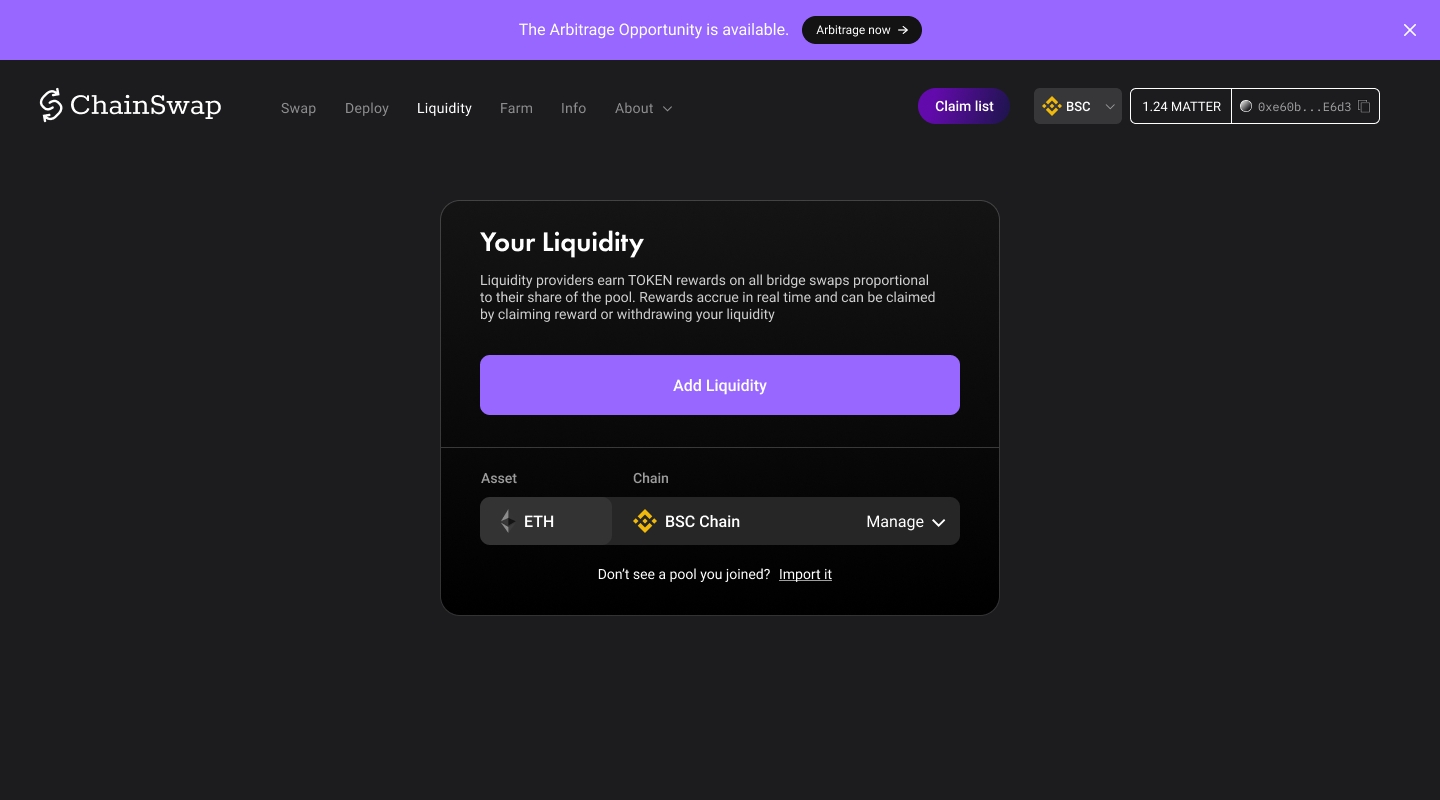

Arbitrage opportunities arise when an user wants to swap more assets than there is liquidity across chains. LP will be able to see arbitrage opportunity notifications on the manage liquidity page.

By clicking on “Arbitrage Now”, LP providers get sent to a page where they can instantly arbitrage their liquidity to complete a pending transaction and see the estimated reward for the arbitrage.

The ChainSwap team plans to implement automatic arbitrage and arbitrage bots in the upcoming future.

The economical system of the ChainSwap Liquidity Bridge is as follows.

Major asset liquidity bridge will be lanching with USDT only. With time we plan to launch and implement additional major assets such as ETH, USDC, ect.

Users will be able to go to chainswap.exchange/liquidity and stake their USDT as a single side LP. To be a liquidity provider, you first need to decide which chain and token you want to provide liquidity for and then stake into the liquidity pool. LPs will be rewarded in form of TOKEN. Rewards are dynamic depending on price of TOKEN.